Understanding BRRRR (For Beginners)

The BRRRR method – which stands for Buy, Renovate (Rehab), Rent, Refinance, Repeat – is a popular real estate investment strategy. Investors buy a property (often a fixer-upper), fix it up, rent it out, then refinance to pull out their initial cash, and repeat the process on another property. The big appeal of BRRRR is that it lets you rapidly grow a rental portfolio by recycling the same cash over and over. Essentially, once you refinance, you get your down payment and rehab money back within a few months, freeing it up for the next deal. This “snowball” effect can build wealth quickly with relatively little of your own money tied up long-term. It sounds great – and it has been a proven strategy – but it relies on key financial assumptions that have become harder to meet in today’s market.

Why BRRRR Was Easier in the Past

Over the last decade (especially in the 2010s), BRRRR thrived in a market with cheap debt and rising home values. Interest rates were low (often under 4%), meaning mortgage payments were modest. Home prices were steadily climbing year over year, so investors could confidently refinance at higher appraised values. Rents were surging in many Sun Belt markets like Tampa Bay, boosting cash flow. All these factors meant that after a rehab, an investor could pull out most or all of their money with a refinance and the property would still cash-flow positive with a traditional tenant.

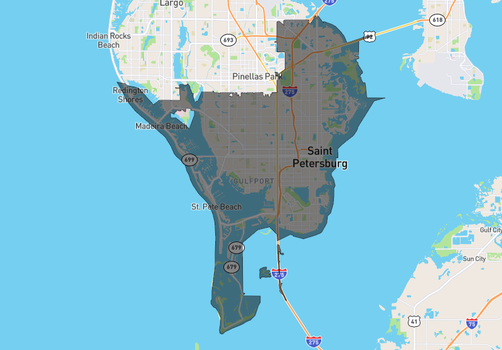

However, in the post-2020 period, conditions changed dramatically. Tampa Bay experienced an explosive housing boom during the pandemic: a wave of people moved in (net migration averaged ~53,000 per year after 2020 during the peak of remote-work relocations). Buyer frenzy pushed home prices up 20-30% annually in some years. By 2022, Tampa area home prices hit record highs – the median single-family price in Hillsborough County climbed to the mid-$300s (up ~18% YoY), and the metro’s average price topped ~$450,000 in 2023. In fact, Tampa home prices jumped about 55% from 2020 to 2024 – a huge appreciation in just a few years. While that boom created equity for some, it also means investors today must pay far more for the same houses than they would have a few years ago.

At the same time, the tailwind of ultra-low interest rates is gone. As of 2023-2025, mortgage rates have hovered around multi-decade highs – roughly 7% to 8% for 30-year loans. This dramatically increases monthly payments. For example, a $300,000 mortgage at 7.5% has a principal & interest payment around $2,100/month, whereas at 3.5% it would be about $1,350. Higher financing costs make it much harder for a property to cash flow (i.e. have rent cover all expenses). As one report noted, in a 6.5-7.5% rate environment, new investors need significantly more income from a property just to cover the debt payments (let alone turn a profit). In short, the math that made past BRRRRs profitable has tightened up considerably.

A Plethora of New Challenges in Today’s Market

BRRRR isn’t impossible in 2025, but it faces headwinds in the current Tampa Bay market. Let’s break down the key challenges:

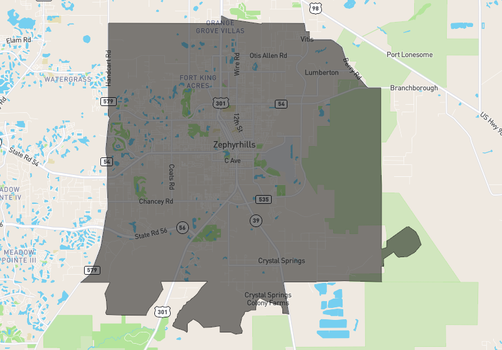

High Purchase Prices: Even though Tampa’s market has cooled slightly from the 2021 frenzy, prices remain very elevated. The median home price in the Tampa area was around $447k in 2024, up more than 50% since 2020. In July 2025, Hillsborough’s median was about $430k. While some nearby counties saw slight dips (e.g. Pinellas -5% YoY due to storm-damaged sales), overall values are far above pre-pandemic levels. For BRRRR investors, that means higher upfront costs and larger mortgages after refinancing. The days of buying a fixer-upper for under $150k in Tampa Bay are largely gone – you might be looking at $300k, $400k or more for the same kinds of properties.

Rising Renovation and Carry Costs: Inflation in materials and labor has driven up renovation budgets. If you buy a distressed house to rehab, expect to pay more for construction than a few years ago. Additionally, the cost to hold properties during the rehab has surged. Many BRRRR investors use short-term hard money loans or bridge financing to fund the purchase and rehab. Those rates can be very steep now (often 10–12%+ annual interest). For example, an investor email discussion in April 2025 noted needing a $350,000 hard-money loan at 12% to buy and renovate a Tampa-area property. That kind of financing, while often necessary to make a “cash” offer, means thousands in interest payments each month during the rehab. It eats into your profit and leaves less room for error. Traditional renovation loans (like 203k mortgages) are an alternative, but in a competitive market they can be hard to use – sellers often reject offers with long financing timelines or appraisal contingencies. As one local agent explained, “Sellers are asking for cash only. Usually we can squeeze a hard money loan in lieu of cash. Renovation loans are more complex and sellers likely won’t want to deal with it.” In short, investors often must resort to costly financing to secure a deal, due to sellers preferring quick cash sales.

Higher Interest Rates on Refi: The whole BRRRR model hinges on that final Refinance step – ideally, you refinance into an affordable long-term mortgage that fully pays off your purchase and rehab costs. But with 30-year loan rates around 7% or higher, the refinance can be a rude awakening. The new mortgage’s payment may be double what a similar loan would have been at 2020 rates. This directly undercuts cash flow. In many cases across the country, the BRRRR strategy stopped “penciling out” when rates jumped (investors found that after refinancing, the rent no longer covered the higher mortgage and expenses). Tampa Bay is no exception. Even though rents also rose in recent years, the rent growth hasn’t kept pace with the jump in financing costs. In fact, Tampa rents have leveled off and even ticked down slightly. The median rent in Tampa Bay in 2023 was about $2,102/month, a 2.6% decline year-over-year after the huge pandemic run-up. So investors cannot count on rapidly rising rents to bail out a deal – rents are high, but flat to slightly down now, while interest expenses are way up.

Skyrocketing Insurance and Taxes: Florida investors have been hit with a one-two punch of property insurance and property tax increases. Tampa Bay insurance premiums in particular have gone through the roof after several bad hurricane seasons starting with 2017's Hurricane Irma. Even outside of flood zones, insurers have raised rates statewide to cover higher reinsurance and claims costs. Florida’s average homeowner’s insurance cost was over $11,000 in 2024 – roughly three times the U.S. average – and Tampa area costs are in that ballpark. An extreme example: one local homeowner’s annual insurance bill jumped from $5,500 in 2022 to $17,000 in 2024. While that case was notable, it’s not unusual for investors to be looking at $4-8k per year for insurance on a single rental house in the Tampa Bay region (especially if it’s in a flood zone or older home). This is several times higher than insurance costs in many other states and absolutely devours cash flow. Property taxes have likewise trended up as home values climbed – Tampa’s median home price increase of ~55% since 2020 means higher assessments (though Save-Our-Homes caps help owner-occupants, a rental property doesn’t get that cap, so taxes adjust upward with market value). Put simply, the expense side of the equation (insurance, taxes, maintenance) has surged in Florida. Investors must budget for these hefty carrying costs. A rental that might gross $24k/year in rent could easily have $10k+ of that eaten by just insurance and taxes now – before even accounting for repairs or vacancies. That leaves very little cushion to pay the mortgage. Affordability has become a real issue, even for landlords: “Home prices soared, but so did insurance, property taxes, and mortgage rates, causing affordability to become out of reach for many,” as a Tampa market report noted of the post-2020 climate.

Tougher Refinancing Appraisals: Another subtle challenge is getting a high enough appraisal on the refinance. In order to pull all your money out, you typically need the new appraised value (after renovation) to be significantly higher than your total cost. During the boom, that was easy – values were jumping so much that a lightly rehabbed property might appraise much higher in a short time. Now with values flattening (Tampa’s median actually held flat year-over-year in 2025), appraisers are conservative. If you bought at market price and put money into rehab, you may find the appraisal only comes back a bit above what you spent. Some investors have been forced to leave cash in the deal because the refi loan-to-value didn’t cover everything. In Tampa Bay, one also has to consider the appraisal might not fully value added rental income from an unconventional use (more on that below) – appraisals for 1-4 unit properties hinge on comparable sales, not how much rent you’re getting. So increasing a house’s rent dramatically doesn’t guarantee the bank will recognize a higher value on the appraisal report.

Given all these factors – high prices, high rates, high expenses, and only modest rent growth – it’s clear why BRRRR has become a lot more difficult. The classic formula is under strain. In many cases, a normal long-term rental in Tampa simply won’t generate enough net income to comfortably cover a new mortgage at today’s rates. Does that mean BRRRR is dead? No, but it demands adaptation. Investors are finding they need to get comfortable with leaving more equity in deals to make the numbers work in 2025 and beyond.

Boosting Cash Flow to BRRRR

One adaptation that’s gaining traction in Tampa Bay is turning properties into PadSplit homes (or similar co-living arrangements) to dramatically boost rental income - I can attest to this firsthand. PadSplit is a co-living platform that helps owners rent out individual rooms in a house to separate tenants (typically working professionals who need affordable housing). By renting each bedroom separately (with shared common areas), a landlord can earn far more total rent than by renting the whole house to one family. In fact, PadSplit reports that on average its hosts earn about 2.5× more income compared to a traditional single-family rental. That kind of increase can be the difference between a deal that fails and a deal that thrives under the BRRRR model.

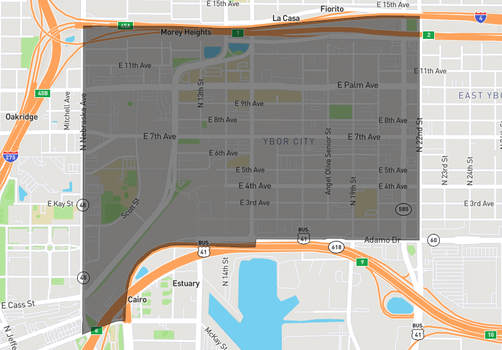

How does PadSplit work? Essentially, you convert, say, a 4-bedroom house into a 6 or 7-bedroom co-living home (often by adding walls to create extra bedrooms, or converting living/dining spaces into bedrooms – all in a code-compliant way). You then rent each room individually, usually with utilities, furniture, and WiFi included in a flat weekly rate. PadSplit handles marketing and tenant screening, and they charge a portion of rent as a platform fee. The tenants (called “members”) sign agreements to rent a single private bedroom and share the kitchen, etc. It’s like an extended-stay house-share arrangement designed for affordability. Many PadSplit renters are service workers, teachers, medical staff, and others who appreciate a clean, furnished room for, say, $700–$900 a month instead of paying $1500+ for a solo apartment.

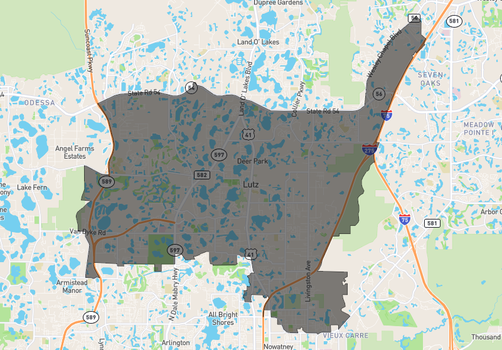

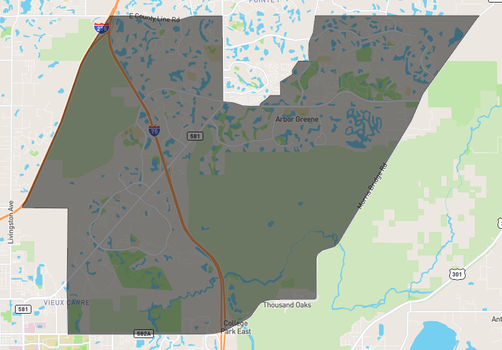

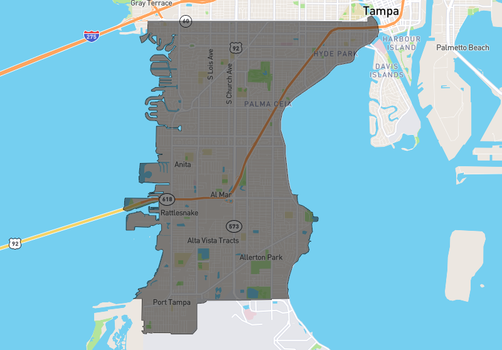

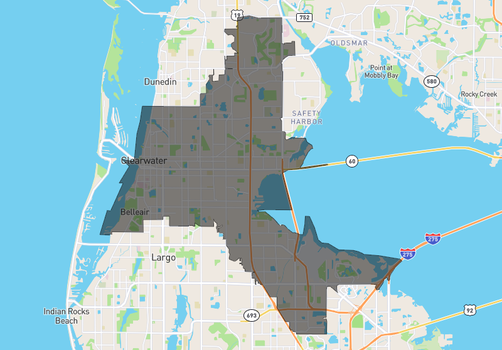

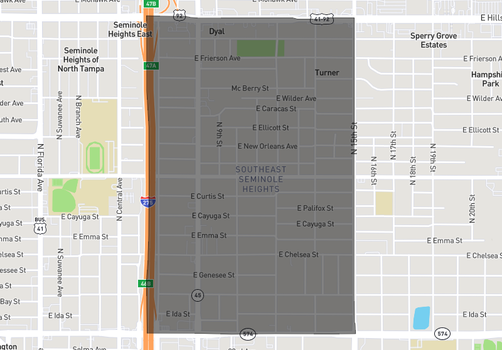

For the investor, the appeal is reliable high cash flow. Tampa has a strong demand for affordable rooms – PadSplit has reported occupancy rates around 92% in the Tampa Bay region in 2025, meaning if you set up a PadSplit, you’re likely to fill those rooms quickly with vetted tenants. Let’s look at what this can do to the numbers:

As a traditional rental, a typical 4-bedroom, 3-bath house in Tampa might rent for around $2400 per month (depending on location) if leased to one family. However, as a PadSplit with, say, 8 rentable rooms (some of those 4 bedrooms might be split into smaller rooms), that same property could generate roughly $6,100+ per month in gross rent. That is an enormous jump in income. Even after accounting for the PadSplit platform fees, higher utilities, and management costs, the net cash flow is much greater. In that illustrated case, after all expenses the PadSplit home still netted roughly 2.5× the monthly profit of the traditional setup.

In essence, PadSplit is allowing BRRRR to still work in Tampa Bay by changing the income dynamics. The strategy is: Buy a house (often a bit cheaper if it’s older or larger and in need of rehab), Rehab and reconfigure it to maximize bedrooms, Rent it by the room for significantly higher total rent, then Refinance. Thanks to the high rent, the property can cover the new mortgage and still have positive cash flow – thereby checking the boxes of a successful BRRRR. You also recoup your capital upon refinancing (potentially even more than you put in, if the appraisal recognizes the improvements). The key difference is you’re not relying on market appreciation or speculative rent growth; you are forcing the cash flow higher through the co-living model. That being said, it's still relatively difficult to do a full BRRRR today. Partial BRRRRs are much more realistic and allow for great cash flow.

Comparing Cash Flow Dynamics: Traditional vs. PadSplit

To truly appreciate this, let’s compare the cash flow dynamics of a traditional rental vs a PadSplit rental in Tampa Bay:

Traditional Single-Family Rental: Suppose you purchase a 3 or 4-bedroom home for $400,000. After a 20% down payment and some rehab, you refinance into a $320,000 mortgage at 7%. P&I on that loan is around $2,130/month. Add, say, $300/month property tax and $300/month insurance (quite plausible in FL), and maybe $150/month maintenance reserve. That’s roughly $2,880 in monthly expenses (not even counting any property management fees). Now, what can you rent this home for on a one-year lease? Perhaps around $2,300/month (the average rent for a single-family in Tampa was roughly $2,100–$2,300 as of 2023). Already, you can see a shortfall – you’d be losing a few hundred dollars per month. Even if you self-manage and cut a few costs, the deal is rarely breakeven and usually slightly negative. This is why many investors say traditional cash flow is very hard to achieve now. In fact, Florida Realtors’ data showed Tampa was one of the most “overvalued” rental markets, meaning rents don’t fully justify the high prices by normal metrics. A lot of single-family landlords in Tampa are betting on long-term appreciation, but month-to-month they have slim margins.

PadSplit/Co-Living Rental: Now take that same house and imagine you rent it out by the room. If you can create, say, 6 rentable rooms, and charge an average of $180 per week per room (around $720/month each – a very competitive price point in Tampa for an all-inclusive room), you’d bring in $4,320/month gross. Even after allowing for PadSplit’s fees (they take around 12% of rent as a platform fee plus a small per-booking fee) and covering utilities, you might net perhaps 70% of that revenue. That’d be around $3,000/month net income. Subtract the same $2,880 in mortgage/tax/insurance costs, and you still have a small positive cash flow (maybe $100–$200/month). Increase the number of rooms or the rent a bit, and the cash flow expands further. For instance, if it’s a large house able to fit 7 or 8 rooms, the gross might be $5k+/month, leaving a very healthy cushion after expenses. The bottom line is that by boosting the rent 2x–3x, PadSplit turns a losing deal into a winning deal.

It’s important to note that co-living does come with additional responsibilities. You as the owner are essentially running a small multi-tenant operation. That means you’ll be paying the utilities (water, electric, internet), furnishing the rooms, and handling more frequent tenant turnover. PadSplit does help by screening tenants, handling week-to-week payments, and even helping with collections and conflict resolution, but it’s not as “set-and-forget” as a traditional lease. You also need to ensure your property’s layout and safety features (like egress for bedrooms, sufficient bathrooms, etc.) meet local codes for renting by the room – this can involve additional renovation work (adding fire extinguishers, locks, maybe extra parking space, etc.). However, many Tampa Bay investors find the extra work is worth it given the significantly higher income. The fact that PadSplit has such high occupancy in Tampa indicates a deep renter demand – meaning vacancy risk is low if you provide a decent product.

Maintaining Cash Flow and Covering Expenses

As we’ve shown, this is not only possible but is actively happening in the Tampa market. The crucial element is that cash flow (rent minus expenses) must be sufficient to cover the property’s own expenses after the refinance. In other words, the property needs to carry itself – otherwise the BRRRR fails, since you’ll be feeding the property each month instead of freeing up cash for the next deal.

With a traditional rental, achieving that in Tampa today is tough. Many investors are finding that even if they get all their money out in the refi, the debt-service coverage (ratio of rent to mortgage payment) is below 1 – meaning negative cash flow. Lenders typically want a DSCR (Debt Service Coverage Ratio) of at least 1.2 for an investment property loan to be sustainable. If your property’s DSCR is under 1.0 (i.e., rents don’t cover the debt), you either won’t get approved for the refinance or you’ll be subsidizing the property out-of-pocket, which defeats the purpose of BRRRR. By contrast, co-living properties often have DSCRs well above 1.2 because of the boosted rent. Even after accounting for the higher operating costs (utilities, furnishings, etc.), the net operating income is high relative to the debt. For example, in the earlier PadSplit case with ~$73k annual gross rent and ~$22k in non-debt expenses, there’s about $51k left to service debt. A $400k loan at 7% costs around $32k/year in debt service, so that property would still cover the mortgage and produce nearly $20k in profit annually – a healthy coverage. This is why many investors pivoting to the room-rental model are still able to satisfy lender requirements and keep their projects viable.

Final Thoughts

In today’s Tampa Bay real estate market, classic BRRRR is undeniably more challenging than it was a few years ago. High home prices, high interest rates, and high holding costs have squeezed the profit margins. Many once-profitable strategies now barely break even when run as conventional rentals. However, as we’ve explored, all is not lost for BRRRR investors - we simply must adapt to unlock higher income. By leveraging an approach like PadSplit co-living, investors can dramatically increase a property’s rent roll, turning steep expenses into manageable ones. The dynamic is straightforward: when one tenant’s rent won’t pay the bills, find multiple tenants who collectively will.

Tampa’s combination of expensive real estate and ongoing housing demand makes it an ideal case for this adaptation. Room-by-room rentals are bridging the gap between what properties cost and what long-term tenants can pay. Importantly, this strategy still aligns with the core of BRRRR – you buy undervalued properties, you add value (through rehab and reconfiguration), you rent for strong cash flow, and you refinance to get your capital back. The difference is that the “Rent” step is turbocharged. Instead of accepting the market rent as a fixed number, you’re creating a new rent structure that better monetizes the property’s space.

For beginners, it’s crucial to run your numbers conservatively. Make sure to factor in all expenses (PadSplit’s fees, utilities, higher turnover costs, etc.) and ensure there’s a cushion. Engage with someone with experience - for example, I recommend a fantastic property manager in Tampa who can provide guidance on ideal locations and layouts.

BRRRRing in today’s market is difficult but not impossible. In Tampa Bay, investors are finding success by focusing on cash flow-centric strategies and getting more comfortable with leaving more money in deals. The PadSplit model is a prime example of innovating to meet the market’s challenges. It allows an investor to BRRRR a property and have it cover its own expenses comfortably, thanks to significantly higher income than a traditional lease would provide. While it’s not a totally hands-off approach, the rewards can be substantial – making the difference between a deal that drains your wallet and one that pads your pockets. By understanding the local market forces and being willing to pivot your strategy, you can still achieve the BRRRR dream even in 2025’s tougher landscape. Tampa’s real estate market may have changed, but with the right approach, you can change with it and come out on top.