~ 5 min read

Selling an investment property isn’t the same as selling your family home. As an investor or landlord in Tampa Bay (or anywhere, really), you’ll face unique challenges and “gotchas” that many real estate agents gloss over. In fact, I recently closed on a Tampa multi that nearly fell apart due to issues most realtors never warn their clients about. In this post, I’ll share the behind-the-scenes story of that deal and dive into the critical truths about selling investment properties that you need to know. I need to share more of these kinds of insights! These are the candid realities that typical agents won’t tell you, but an experienced investor-agent will.

Tenants in Place.. The Good, the Bad, and the Ugly

One thing most realtors won’t tell you upfront is how big of a factor your tenants will be in the sales process. Selling with tenants in place can be a double-edged sword:

The Good: Having paying tenants can make your property attractive to other investors. A buyer stepping into immediate rental income might view it as a turn-key opportunity. In a hot rental market like Tampa Bay – where rents have surged 49% from 2019 to 2023 alone– a property with existing tenants (especially at below-market rent) has built-in upside. Also, you continue to collect rent through the sale period, which softens the carrying costs while listed.

The Bad: Tenants add complexity. You have to coordinate showings and inspections around their schedules, and not all tenants are cooperative. Some might refuse showings or keep the place messy, which can hurt your sale. Florida law says tenants must allow reasonable access for showings with proper notice, but enforcing that politely is an art. Many agents won’t emphasize how much tact it takes to keep tenants happy (so they don’t sabotage your sale).

The Ugly: A disgruntled tenant can flat-out wreck your deal – from denying entry to spreading negativity to would-be buyers. Even good tenants create uncertainty: what if they decide to move out right before closing, or stop paying rent if they suspect an ownership change? Most realtors won’t talk about these worst-case scenarios at listing appointments. But as a landlord, you know it’s a risk, and a savvy agent will help you plan for it (for example, by offering tenants an incentive to cooperate, like a rent discount or cash for keys if you need them to vacate early).

Perhaps the biggest “ugly” surprise is what we experienced on UNB: the buyer (or their agent) not understanding tenant rights. You might assume any realtor knows a lease stays in effect after a sale, but as my story showed, that’s not guaranteed. Misguided attempts to “handle” tenants by force can blow up in everyone’s face. Fortunately, in our case, cooler heads prevailed once we clarified that leases are legally binding and can’t be tossed aside.

Work with your tenants, not against them. Inform them (at the appropriate time) about the sale and assure them their lease and rights will be honored. A little empathy goes a long way – something many realtors forget when they’re laser-focused on just making the sale. Happy tenants = smoother showings and transition. Don't lie to them and says it's just an insurance inspection.

Challenging Repairs and Circumstances

Owning rental properties often involves playing the deferred maintenance game—you make repairs good enough to keep tenants comfortable, but rarely HGTV-level perfect. However, when it's time to sell, these neglected or half-done repairs can suddenly become critical issues. Here's something most realtors don't proactively share with investor-sellers: unaddressed repairs or open permits can seriously derail your closing.

Let me illustrate this with the HVAC permit nightmare from my recent UNB deal. Three months prior to closing, the property manager had opened a permit to replace a failing HVAC system. However, for three entire months, nothing actually got done. Why? Because replacing this HVAC wasn't straightforward—it had to be moved from the attic into the main living area. This raised a critical question: where should it go? Did we need to build a dedicated HVAC closet? Where?

Deciding this turned into a frustrating dance between the property manager, HVAC installers, and various closet builders. Multiple contractors came in to provide estimates, countless emails and calls went back and forth, and weeks disappeared without any progress. It wasn't until the seller and I personally stepped in, taking direct charge of the process, that we started seeing real momentum. My preferred HVAC company took one look and had a plan all laid out to be completed within a week. Unfortunately we were so far in with the existing contractors that it was decided to stay on with them for payment and permit continuity.

Finally—just three days before closing—the HVAC was installed. But we weren't out of the woods yet. The county inspection was still pending, and on the day we were initially scheduled to close, the permit had not yet been approved. Fortunately, a quick follow-up visit to correct a minor issue got us the approval we desperately needed, narrowly averting a potentially significant closing delay. Why? Because all of a sudden the buyer needed to urgently leave the country and couldn't even delay a day!

Here's the takeaway: an unresolved repair is not just paperwork; it's a ticking clock. Many agents won't thoroughly check permits or recent major repairs upfront, but these issues can and will stall your sale at the worst possible time. Rather than just tidying up the property cosmetically for showings, ensure your agent proactively verifies that all permits—especially for recent roofing, HVAC, plumbing, or electrical work—are done timely and properly closed out.

The HVAC drama we faced underscores why transparency and proactive management are crucial. Instead of merely reacting to last-minute problems, smart sellers and seasoned agents anticipate them.

When Buyers (or Their Agents) Don’t Know What They Don’t Know

We often assume all parties involved in a sale will be competent. I wish! The reality is, you might encounter buyers or agents who are out of their depth – especially in an investor-heavy market like Tampa Bay, which in recent years has seen an influx of new investors and realtors chasing those deals. Here’s something most listing agents won’t tell a seller: “There’s a chance the buyer or their agent might create some chaos due to inexperience, and we’ll have to manage that.”

In my multifamily story, I’ve already described how the buyer’s agent had some misguided ideas about handling tenants. But get this – we also discovered late in the game that the buyer was using the wrong type of financing. She was purchasing this multi (which was fully rented out) using a primary residence conventional loan, not investment conventional loan. Their pre-approval letter did not indicate the loan as a primary!

Now, it’s actually possible to buy a 2-unit property with a primary residence loan if you intend to live in one unit. But in this case, the buyer wasn’t able to move in within 2 months. If the lender had realized this, the loan could have been denied as an improper use of an owner-occupant rate. This was essentially a loan fraud risk (perhaps inadvertently – maybe someone advised her to do this to get a better rate).

I remember emailing my broker about it, a bit stunned: “Literally never had an agent try to do this before 🤯. We decided that it wasn’t our job to police the buyer’s financing lies; that was on her lender and agent. Our focus was protecting our seller’s interests. We were however obligated with title to disclose the leases to the lender. If they ignored or did not choose to enforce, that was on them.

Why do I bring this up? Because if a deal falls apart from something like that, many listing agents will just shrug and say “bad luck.” But an agent who regularly works with investors is more vigilant. I now always check what type of loan a buyer is using for my listings. If I see a primary residence loan on a tenant-occupied multifamily or a rental home where the buyer clearly isn’t moving in, I raise an eyebrow. It could be nothing – maybe the buyer plans to house-hack (live in one unit). Most realtors won’t discuss this nuance with you, the seller, because financing is “the buyer’s problem.” Yet it becomes your problem when closing gets delayed or canceled. So choose an agent who has the savvy to sniff out these issues early.

Another aspect here is timeline management. Our buyer, as I mentioned, had to fly to their home country for a true emergency just as we were approaching closing. This gave us no wiggle room on an already difficult situation.

We got this request on a Wednesday, with unfinished repairs and an open permit still on the table! Talk about pressure.

I hustled with the title company, asking if we could arrange a mail-away closing Via the US embassy in the home country or remote notarization if needed. We pushed hard to get that HVAC permit cleared and all documents ready. In the end, we closed the following Monday – a few days past her ideal, but just in time before she left for her flight. The buyer signed, the deal closed successfully, and everyone breathed a sigh of relief.

The point: Investor sales often involve out-of-town buyers, tighter timelines, 1031 exchange deadlines, or other complications. Not all realtors are equipped to handle these curveballs. An agent who specializes in working with investors will be more prepared to troubleshoot these scenarios – whether it’s accelerating a closing, dealing with foreign buyer paperwork, or simply keeping a deal together when things get weird. Always ask your agent: Have you dealt with tenant-occupied sales? Out-of-state or foreign buyers? Permitting issues? Their experience (or lack thereof) will become very apparent in their answers. There were two moments in time where UNB was actively falling apart and nearly over, but it was revived through phone calls and quick work.

Not All Realtors Are Created Equal (Especially in Tampa Bay)

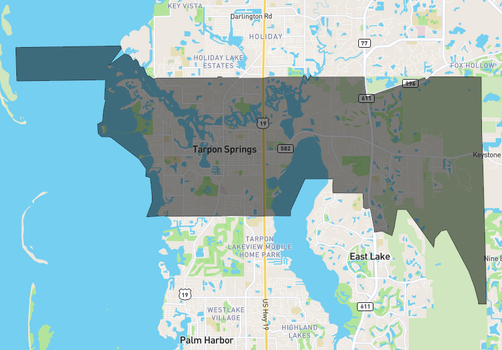

If you’ve read this far, you might be thinking, “Wow, selling an investment property is complicated!” – and it can be. But with the right preparation and the right real estate representation, it can also be smooth and highly profitable. Tampa Bay’s market has been booming for investors, with high rental demand and price growth. That also means a lot of agents are trying to get a piece of the action, not all of whom actually understand investor needs.

Consider this: Selling with tenants in place can limit your buyer pool, since many folks prefer a vacant property. A typical realtor might not emphasize this, but an investor-focused one will discuss whether it’s better to wait for leases to end or how to market the property specifically to investors. In Tampa, we have a huge influx of investor buyers – from big corporations buying up homes, to mom-and-pop landlords expanding their portfolio. (Private equity firms alone own roughly 1 in 10 Florida rentals now, as the Tampa Bay Times reportedproject.tampabay.com.) This is great news for sellers of rentals – you have plenty of potential buyers – but it also means you’ll deal with a range of buyer sophistication. Some will be pros who own 20 properties; others might be first-timers lured by Florida sunshine and HGTV dreams. Your realtor should be capable of handling communications with both extremes – explaining tenant situations to newbies and answering detailed ROI questions from seasoned investors.

Since not all agents have that skillset, choose your representative wisely. Ask them how many tenant-occupied properties they’ve sold. Quiz them on what Section 6(b) of the Florida purchase contract requires (that’s the part about leases and deposits – the one that tripped up the agent in my story!). A good agent may not have the actual section memorized word for word, but can interpret it in seconds: deliver copies of leases, and transfer deposits at closing. They’ll also be able to tell you strategies for handling tenants, ideas for maximizing sale price (like minor upgrades or rent adjustments), and common pitfalls to avoid. If instead you hear crickets or generalities, you might end up being the one educating them – or suffering the consequences of their trial-and-error.