Homes Are Taking Longer to Sell

Another clear shift in summer 2025 is that properties are spending more days on market before going under contract. Homes aren’t selling overnight like they did in 2021. Median time to contract in the Tampa Bay metro is now roughly 37 days, up from about 30 days a year ago (+23% YoY). In other words, it now takes about 5–6 weeks on average to find a buyer, whereas last spring it was just over 4 weeks. If you include the typical closing period, the median time from listing to final sale is around 2½ months ( ~75 days).

This slower pace is echoed in regional data and agent observations: In April, Tampa-area homes sat a median of 54 days on market, about 10 days longer than April 2024. Buyers have more homes to choose from and less urgency, so multiple-offer bidding wars have cooled. Well-priced, move-in-ready homes still sell relatively quickly, but even those might get 2-3 offers over a couple of weeks, not 20 offers on day one. “Stale” listings (those sitting 2+ months) are becoming more common in mid-2025, a sign that buyers are choosier and less willing to rush into a purchase – especially at today’s interest rates.

For sellers, this means patience is key. Expect more days (or weeks) of showings and marketing. It’s now crucial to price your home competitively and make it show well from the start. The average sale is closing at about 96% of the original list price, which means buyers are negotiating and discounts of 3-4% off asking are typical. Last year, sellers often got close to their full asking price; this year, buyers are bargaining a bit more and contingencies (inspections, appraisals) are making a comeback in offers.

On the buyer side, the longer market time is a welcome change from the past 4 years. Buyers have a bit more breathing room to view multiple homes and think before they bid. You may even get a second chance at a home that didn’t immediately sell, and counter-offers from buyers are back on the table. That said, prime homes – those priced right and in desirable condition/location – can still sell fast, so serious buyers should not dawdle too much on the best finds. The market hasn’t flipped to a full buyer’s market; it’s **more of a balanced market now.

Inventory is Up, Giving Buyers More Options

Perhaps the biggest change in Q2 2025 is the surge in housing inventory around Tampa Bay. After years of ultra-low supply, the number of homes for sale has significantly increased over the past 12 months. As of this spring, active listings in the Tampa Bay metro (single-family) were about 12,800+, which is ~37% higher than a year ago. Put another way, buyers in summer 2025 have one-third more homes to choose from than they did in summer 2024. This build-up of inventory has pushed the months’ supply (the time it would take to sell all homes at the current pace) to roughly 3.9 months – up from ~2.9 months last year.

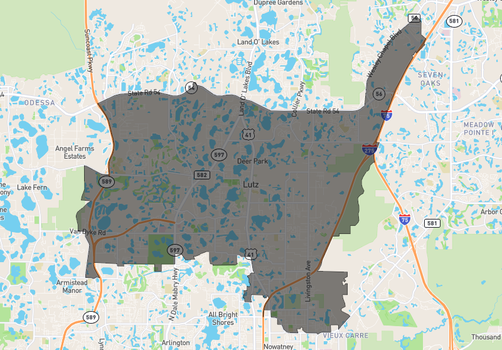

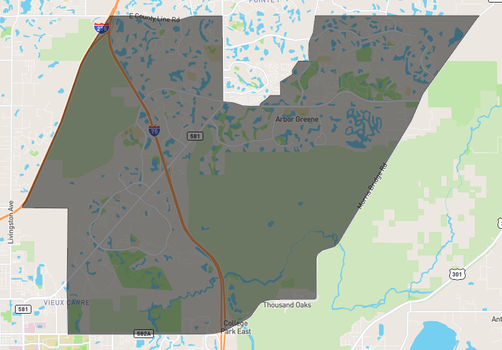

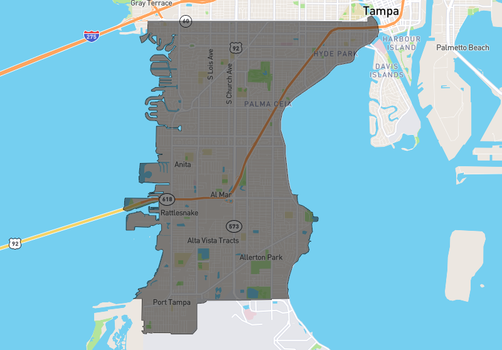

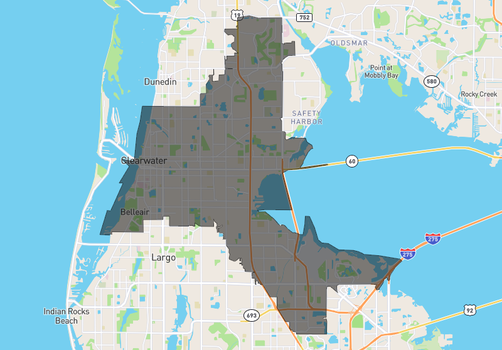

Inventory growth is a region-wide trend: All three counties – Hillsborough, Pinellas, and Pasco – have more homes on the market now. Pinellas County, for example, has over 9,100 homes for sale (all property types), up about 30% from last year. Statewide, Florida hit a 13-year high in listings this winter with over 172,000 homes on the market. Tampa Bay is no exception; the jump in supply is one of the reasons our market has cooled from a boil to a simmer.

Why the inventory surge? A few factors are at play:

New Listings Picking Up: After holding back in 2022-2023, more homeowners are deciding to sell. New listings in our area were up about 9% year-over-year this spring. Some people are moving for jobs or family as the world normalizes post-COVID, and others are investors exiting after big equity gains.

Fewer Immediate Sales (Longer DOM): Because homes aren’t selling as instantly, listings are “stacking up” on the market. Instead of a home listing and going under contract in 5 days, it might take 5-6 weeks. That means at any given time, more active inventory is available, even if buyer demand is still there. In short, slower sales velocity = higher active inventory.

Buyer Demand Easing: Higher interest rates and affordability challenges have sidelined some buyers (more on that below). Pending sales in Florida were down ~9% year-over-year in January, according to Redfin, and in April pending sales dipped ~3.2% nationally. Fewer buyers transacting means more homes remain unsold in inventory.

Post-Pandemic Adjustments: The frantic pandemic migration is stabilizing. While Tampa Bay still gains new residents, it’s at a calmer pace than 2020-21. Meanwhile, home builders have ramped up construction in Florida, adding new supply. And some owners are selling second homes or investment properties as carrying costs (taxes, insurance) climb. All of this boosts inventory.

For buyers, the uptick in inventory is a welcome relief. There are more choices now in every price range. We’re finally seeing fully stocked resale listings plus new construction spec homes on the market, rather than everything being snapped up immediately. With 3.5–4 months of supply, Tampa Bay is approaching a balanced market (traditionally ~5-6 months is considered equilibrium between buyers and sellers). We’re not quite there yet, but certainly far more balanced than the <1 month supply we saw at the peak of the frenzy.

For sellers, rising inventory means more competition. To stand out, pricing and presentation are crucial. Gone are the days of listing at an aspirational high price and getting 10 offers in 48 hours. You’ll likely be competing with several other similar homes in your area. Many sellers are now offering incentives – for example, covering some closing costs or buying down the buyer’s mortgage rate – to attract offers. Strategic home prep and staging can also give your listing an edge in this more crowded field.

It’s worth noting: Even with the recent gains, inventory is not sky-high by historic standards. Realtor.com data shows active listings are still about 16% below 2017-2019 (pre-pandemic) norms. Many homeowners remain locked-in with ultra-low interest rates and are reluctant to sell (often called the “rate lock-in effect”). So while buyers have more options now, we’re not flooded with a glut of homes – it’s more like a normalization. The market hasn’t crashed; it’s resetting to a healthier supply-demand dynamic.

Shifting Buyer Behavior in Tampa Bay

With higher mortgage rates and economic uncertainties, buyer behavior has shifted notably in 2024-2025. Here are some key patterns we’re seeing among Tampa Bay home shoppers this summer:

More Cautious and Price-Sensitive: Buyers are more cautious and budget-conscious now. With interest rates roughly double what they were a few years ago, many buyers have hit an “affordability ceiling.” There’s a sense of “affordability fatigue” after years of soaring prices. Rather than stretching to their max, buyers are sticking closer to their budgets and sometimes offering below asking price (especially if a home has been on the market a while). Big-ticket purchases like homes are something people are willing to postpone if they feel unsure about the economy. This has led to fewer bidding wars and more contingent offers.

Negotiation and Contingencies are Back: In 2021-2022, many buyers waived inspections or appraisal contingencies to win homes. Now, with less competition, buyers are less inclined to waive protections. It’s become common again for offers to include inspection periods, appraisal clauses, and even home sale contingencies. Buyers know they have more leverage, and they’re using it – whether it’s negotiating repairs after inspection or asking for seller-paid closing costs. The average Tampa home is selling ~3-4% below list price, which shows buyers successfully negotiating some discounts.

Focus on Value: Today’s buyer will often pass on an over-improved or overpriced house and instead seek better value elsewhere. Homes that are turnkey and priced fairly are still selling, sometimes quickly. But if a property needs work or is priced above the comps, buyers are quick to retreat or wait for a price drop. We’re also seeing some buyers broaden their home search to more affordable neighborhoods or outlying areas (like farther into Pasco or up into Hernando County) to get more house for the money.

Out-of-State and Investment Buyers: Tampa Bay enjoyed a flood of out-of-state buyers the past few years (from the Northeast, Midwest, West Coast) as well as investors snapping up homes. That tide has ebbed slightly. Migration to Florida is still positive, but rising prices and insurance costs have made some investors pause. Investor and second-home demand has cooled compared to 2021’s peak. For instance, a USF economist noted that retiree and investment buyers on Florida’s Suncoast have pulled back as their stock portfolios or cash yields make them rethink real estate purchases. In Tampa Bay, we still have plenty of new residents coming in (keeping demand from falling too far), but local end-user buyers now dominate the market more than pure investors. The proportion of cash buyers remains elevated (about 1 in 3 sales are cash in Florida), yet even some cash buyers are bargaining hard given the softer conditions.

Overall, buyer sentiment is improving somewhat with the increase in inventory – there’s less frustration – but it’s tempered by high borrowing costs. Serious buyers are out there, but they’re taking their time, comparing options, and only pulling the trigger when a home truly fits their needs and budget. The good news for sellers is that well-priced homes do sell; the buyer pool is still active, just more selective and value-driven now.

Fed Policy, Mortgage Rates, and Housing Activity

A big wild card for late 2025’s housing market will be the direction of the Federal Reserve’s monetary policy – specifically, what happens with interest rates in the second half of 2025. The Fed’s actions indirectly impact mortgage rates and thus housing demand. Here’s a look at where things stand and what might be coming:

Current State of Rates (Mid-2025): The Fed aggressively raised rates in 2022 to combat inflation, then reversed course with a few rate cuts in late 2024 as inflation began to cool and economic growth slowed. So far in 2025, the Fed has mostly paused on further changes, keeping the benchmark federal funds rate steady in its early-year meetings. As a result, mortgage rates have stabilized in the mid-6% range. As of May 2025, the average 30-year fixed mortgage is around 6.8% – down a bit from the 7%+ peaks of 2023, but still much higher than the ~3% rates of a few years ago.

Outlook for the Second Half of 2025: Many housing experts anticipate only a modest decline in mortgage rates later in 2025, contingent on the Fed’s moves. The Fed doesn’t directly set mortgage rates, but their policy and the broader economic signals influence the bond market (and mortgage rates tend to follow the 10-year Treasury yield). Currently, the consensus is that the Fed will maintain a “wait and see” stance over the summer, only cutting rates if inflation clearly continues downward or if the economy softens significantly. Mike Fratantoni, chief economist of the Mortgage Bankers Association, expects only a “slight downward trend” in mortgage rates over the remainder of 2025. Similarly, other analysts note that unless inflation returns to the 2% target, mortgage rates are likely to “remain in the high 6 percent range” through the spring and potentially into the fall.

By late 2025, if the economy allows, the Fed could start gently cutting rates. Forecasts vary: For example, Fannie Mae’s economists predict 30-year mortgage rates might dip to ~6.2% by the end of 2025, while the Mortgage Bankers Association is less optimistic, seeing rates closer to 6.6–6.7% by year-end. Realtor.com’s forecast is in line with Fannie’s, expecting about 6.2% by late 2025. In any case, no major forecaster expects rates to plummet back to 4% – or anything near the pandemic-era lows. The “new normal” for mortgage rates may be somewhere around 6% give or take, at least for the next year or two.

Impact on Tampa Bay Housing: If the Fed holds rates high (or even hikes again) to ensure inflation is defeated, mortgage rates would stay elevated ~6.5-7%. That would likely keep a lid on how much home prices can rise because buyer purchasing power is constrained. We might see continued flat or slight downward price pressure into late 2025 in that scenario, and sales volumes could remain on the slower side as some buyers simply hold off. On the flip side, if by Q4 2025 the Fed signals clear rate cuts, mortgage rates could dip into, say, the low-6% or even high-5% range. Even a one percentage point drop in mortgage rates can meaningfully expand buyer affordability, which would energize the market. More buyers would likely re-enter the market, and we could see an uptick in sales activity and perhaps a stabilization or bump in prices as demand picks back up. (It’s a bit of a balancing act – lower rates improve affordability, but they also tend to encourage competition which can drive prices up again.)

Many local real estate agents are advising buyers that today’s high rates may be temporary, but a home you love is forever – in other words, if you find the right house, you can “marry the house, date the rate.” There is optimism that sometime in 2025 or 2026, homeowners will get a chance to refinance at lower rates once the Fed has safely eased off the brakes on the economy. Zillow’s research team, for instance, expects mortgage rates to gradually decline in 2025 and beyond, which they believe will boost home sales and modestly increase prices after a sluggish 2024. In Tampa Bay, Zillow forecasted home values might decrease ~2% in 2025 before picking up again thereafter – basically a soft landing for our market.

Bottom line: Keep an eye on Fed meetings and inflation reports in the coming months. They will heavily influence mortgage rate direction. Late 2025 could bring a turning point: either continued high rates if inflation is sticky, or the start of a rate relief if economic conditions permit. For now, plan for rates in the 6’s and budget accordingly. Any surprise dips in rates should be viewed as an opportunity (for buyers to lock in a better rate or for sellers to market to a larger buyer pool), but don’t count on a dramatic drop. The Fed’s own projections suggest only gentle rate reductions ahead, so housing in Tampa Bay will likely continue on its current trajectory of measured activity and gradual rebalancing rather than any wild swings.