Why You Should Stop Using Cap Rates

Internal Rate of Return (IRR) is often considered a more comprehensive metric for evaluating real estate investments, particularly those expected to appreciate in value or generate increasing income over time. Unlike a cap rate – which provides a point-in-time yield based on current NOI – IRR looks at the entire life of the investment. It factors in all future cash flows (annual rental profits, any projected rent increases, and the proceeds from an eventual sale) and the timing of those cash flows. In essence, IRR is the annualized total return an investor would earn from a property, taking into account the time value of money. It answers the question: “What is my effective annual return if I hold this property for X years and then sell?” This makes IRR a powerful tool for appreciating assets. In a high-growth market like Tampa, investors often anticipate that rents will rise each year and that the property’s value will increase significantly by the time they sell. A static cap rate doesn’t capture those dynamics – it might show a 5% yield today, but it ignores that next year the NOI could be higher and that you might sell the property in 5 years for a substantial gain. IRR, by incorporating those factors, “tells the whole story” of an investment’s performance. It is essentially a multi-year ROI that includes rental income and appreciation, giving a deeper view of profitability over the holding period. As one source explains, cap rates provide only a snapshot of a property’s value at a given moment, whereas IRR provides an overall view of the total returns on an investment on an annualized basis. In other words, cap rate is what the property yields now, IRR is what you project to earn in total each year over the life of the investment.

Cap Rate vs. IRR – Key Differences

In short, cap rates are simple and handy for a moment-in-time snapshot, but IRR is the more holistic metric that captures an investment’s full journey. This is critical in Tampa Bay’s market, where that journey often includes significant appreciation. For example, imagine you purchase a duplex in Tampa at a 5.5% cap rate. If rents increase a modest 4–5% per year (very plausible given Tampa’s recent rent growth) and you sell the property in 5 years at a higher price, your IRR on that duplex could end up being in the low double-digits – far above the initial 5.5% cap. The IRR calculation would account for those yearly rent bumps compounding and the lump sum profit at sale, giving you a true picture of your annualized total return. The cap rate alone would have never hinted at that outcome, since it didn’t reflect growth.

Notably, IRR is agnostic to property type – it can be used for a single-family rental, a fourplex, or a 10-unit apartment; the math simply cares about cash flows. This makes IRR a common yardstick to compare any investment (real estate or otherwise) in terms of yield over time. Many savvy investors in Tampa Bay set target IRRs for their projects. For instance, they might aim for a 10–15% IRR over a 5-year hold, even if the going-in cap rate is only ~5%. Hitting that IRR might rely on executing value-add improvements, raising rents, and benefiting from Tampa’s rising property values. The cap rate at purchase is just one piece of the puzzle – the IRR tells them if the total puzzle is attractive.

Using IRR to Guide Decisions

Emphasizing IRR doesn’t mean cap rates are irrelevant – in fact, both metrics complement each other. Investors often look at the cap rate to ensure they aren’t overpaying for current income, then turn to IRR to project the deal’s multi-year performance. In Tampa’s competitive market, you might encounter relatively low cap rates (due to high prices), but a high projected IRR if the asset’s income and value are poised to grow. This is common in areas of Tampa Bay experiencing revitalization or strong population influx, where today’s rents are decent but tomorrow’s rents could be even better.

It’s important to approach IRR projections with realistic assumptions. Estimating IRR requires forecasting future rents, expenses, and an eventual resale price – essentially an educated guess about the future. Because of this, honest underwriting is key. Conservative investors might even calculate an IRR using only known numbers (e.g. current NOI and a very modest appreciation rate) to avoid overly rosy scenarios. Nonetheless, even with conservative inputs, IRR gives a much clearer view of an investment’s potential than cap rate alone. It forces you to think about the exit strategy and how growth will impact returns.

For a market like Tampa Bay – which has shown both strong rental demand and robust appreciation – IRR is arguably a better yardstick of success. Cap rate can tell you Tampa’s rents are a solid return relative to prices (say 6%), and you can compare that to other markets’ caps. But IRR will tell you how a Tampa investment might perform over time, factoring in that Tampa’s rents and values have been trending up. It captures the benefit of riding the wave of Tampa’s growth. This is why many investors prioritize IRR: it aligns with the ultimate goal of building wealth over time, not just securing yearly cash flow.

Tampa Bay’s cap rates for residential and small multifamily properties are in the mid-single digits – a general indicator of decent immediate yield in a high-growth market. This serves as a useful benchmark for comparing Tampa to other markets, though it’s a broad average and individual deals will vary. However, when it comes to evaluating appreciating assets with rising income streams, the Internal Rate of Return is a far more insightful metric. IRR accounts for the full lifecycle of the investment – capturing rental increases, compounding cash flows, and eventual resale gains – giving investors a true gauge of their annualized return. In a market like Tampa where both rents and property values are climbing, focusing on IRR can highlight opportunities that a simple cap rate might miss.

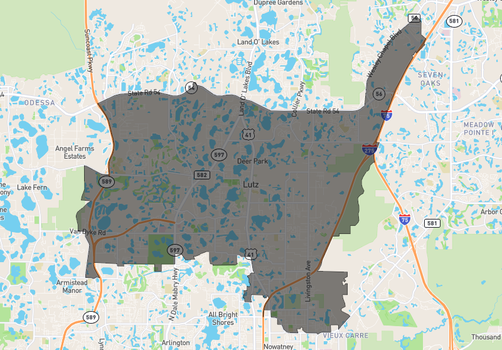

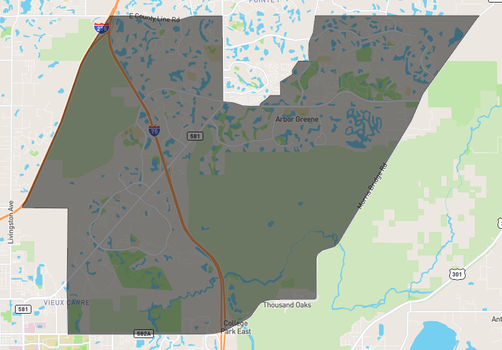

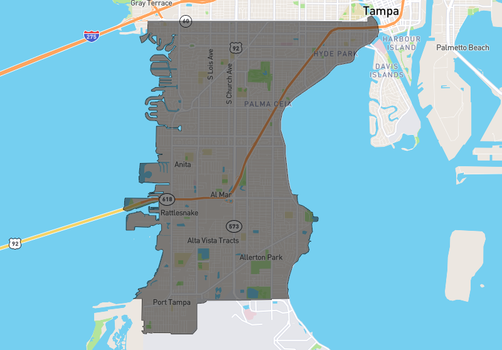

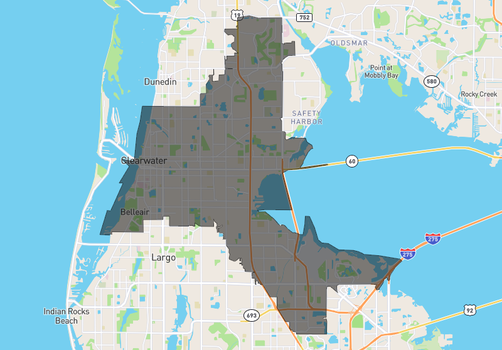

Smart investors use cap rates and IRR in tandem: the cap rate to ensure a baseline of current return and relative value, and the IRR to project the wealth they can build as the property (and the Tampa market) appreciates. If you’re comparing opportunities, especially across different cities or property types, IRR provides the common ground to judge them by the total outcome, not just year one. So, as you look at Tampa Bay real estate – whether a single-family rental in Lutz or a 10-unit apartment in St. Pete – remember that the cap rate is just the starting snapshot. To see the big picture of an investment’s promise, zoom out with IRR and factor in the growth. In the long run, it’s the internal rate of return that truly measures how hard your money is working for you in Tampa’s thriving market.