Brightline is the private passenger rail that links Miami and Orlando. Tampa has long been next on the wish list. The history is long, the money is real, and the impact—if it’s built—could reshape parts of downtown Tampa, Ybor, and the I-4 corridor.

Here’s a quick recap of how we got here and what to watch if you invest in Tampa Bay.

How Brightline got here

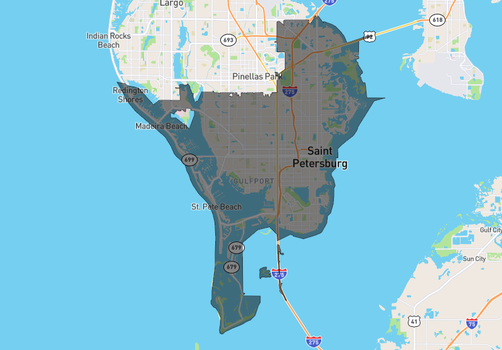

Brightline opened in South Florida in 2018, first between West Palm Beach and Fort Lauderdale, then to Miami. Service paused during the pandemic and later resumed in 2021. By September 22, 2023, trains were running to Orlando, which marked a major pivot point for the whole system.

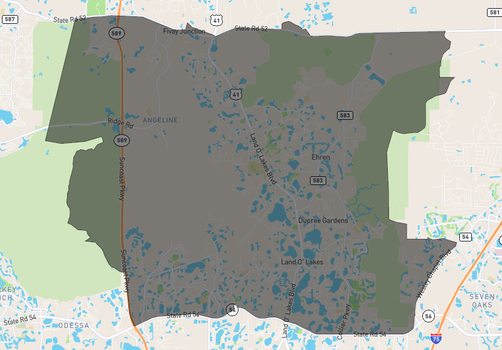

Back in 2018, Florida DOT cleared a path for a Tampa leg, allowing Brightline to negotiate use of the I-4 corridor. In early 2022, Brightline and FDOT signed a right-of-way access agreement for an alignment that parallels I-4, and the company picked up a federal grant for early engineering. Those steps have been the backbone that turned a Tampa route from talk into a realistic plan.

What changed after Orlando opened

Once Orlando came online, Brightline connected to the state’s biggest visitor market and to Orlando International Airport. Since then, the case for an Orlando–Tampa segment has only grown. The company has reported record months, even as it kept testing schedules and fares. That momentum didn’t guarantee the Tampa extension, but it showed demand wasn’t just a South Florida story.

The Tampa extension in plain English

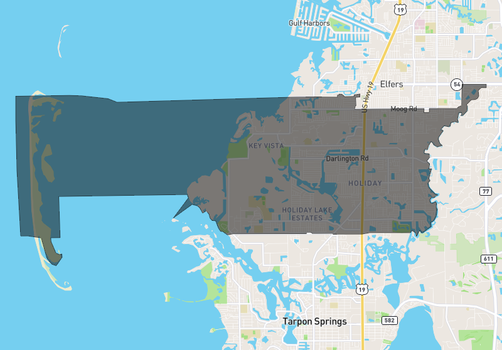

The plan calls for a passenger line running mainly along I-4 from Orlando toward Tampa, with the trip targeted at about an hour. Through the “Sunshine Corridor,” Brightline would share some track and stations with SunRail near the attractions area before continuing west to a terminal in greater downtown Tampa. Think of it as a reliable spine that links three big job and tourism centers. If the pieces fall into place, trains will be moving people instead of cars for that stretch many of us have been driving for years.

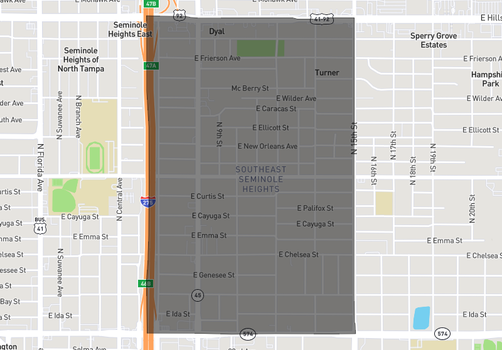

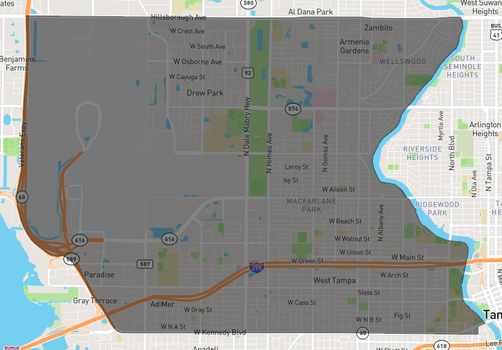

Where the station likely lands

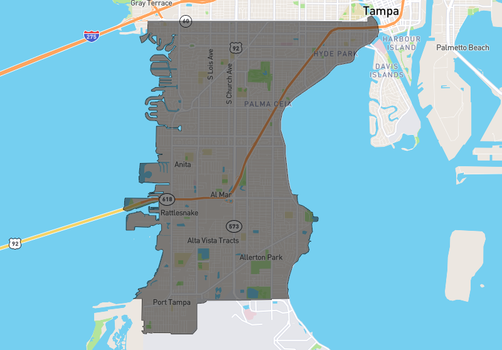

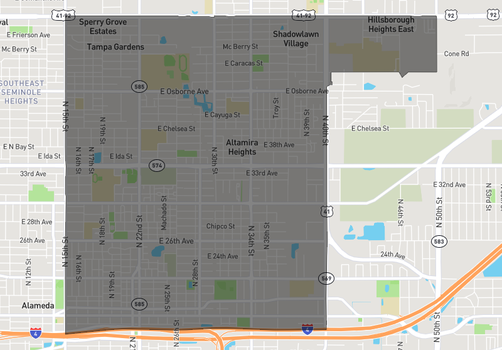

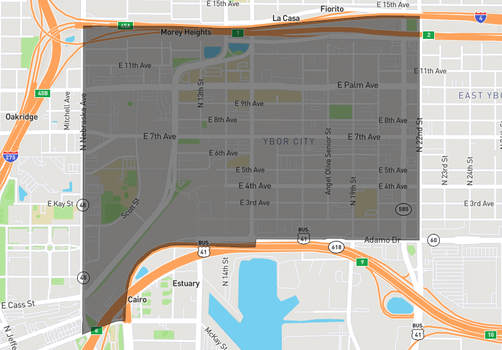

Hillsborough’s Transportation Planning Organization ran a 2025 station-area study and public survey to prep for a site in the “greater downtown” footprint. City leaders have floated Ybor as a contender, and Brightline has said it identified a site but can’t disclose it yet. The study focuses on how people would reach the station—car, rideshare, walking, and biking—and on early access fixes. When the location is announced, expect a burst of parcel speculation around the selected blocks.

The current financing picture

In July 2025, Brightline asked the Florida Development Finance Corporation to issue up to $400 million in tax-exempt private-activity bonds. That money would push design forward, fund station work, and cover some corridor improvements tied to the extension. If those bonds close, the project will move from “planning-heavy” into “design and early works,” which investors will notice.

At the same time, the company has been reshaping its balance sheet. Some Brightline Florida bonds were downgraded in May and again in late July, and reports noted a permitted deferral of a July interest payment. Those are warning lights to track—not death blows—but they matter for timing. If financing tightens, milestones may slip; if markets ease, progress could accelerate.

What completion would mean for Tampa real estate

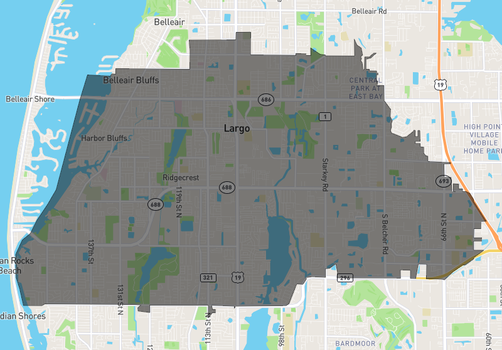

Downtown and Ybor add a demand driver

Stations concentrate people and spending. MiamiCentral stacked hundreds of apartments, office space, and retail around its platforms, and the area kept filling in. Tampa won’t copy-paste that, but a downtown or Ybor station would nudge more mid-rise mixed-use, increase daytime population, and lift demand for furnished 6–12 month leases that serve business travelers.

Hotel and hospitality see spillover

Rail creates short trips that skip I-4. That’s good for weekenders and conferences. A station tied into the Riverwalk and arena districts would boost room nights and help restaurants fill shoulder periods. Owners of mixed-use buildings could capture some of that with small corporate-housing stacks that sit inside normal lease terms.

Office leasing gets a practical pitch

Recruiting from Orlando and Lakeland becomes easier when a commute is a one-hour train session with Wi-Fi. Employers that hire statewide may market a walkable, rail-adjacent address. Even a modest rise in tour volume helps absorption for modern Class A space near the station.

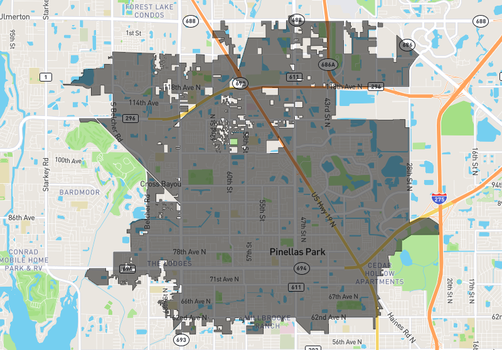

Retail rents follow the feet

Rail riders buy coffee, lunch, and last-minute items. Ground-floor space around the station tends to lease faster once trains start rolling. As nearby rooftops fill in, you usually see more stable foot traffic and slightly firmer base rents within a 5–10 minute walk.

Multifamily premiums are about access, not luxury

The strongest rent lift flows from time savings and travel certainty, not marble finishes. Units within a 15-minute walk of the station—or on a proven shuttle route—can command a premium, especially with secure parking and a work-from-home nook. In South Florida, station ZIP codes have outpaced their counties since 2018, which suggests proximity can add pricing power. Tampa would likely rhyme with that pattern, even if the numbers come in lower.

Westshore and TPA catch secondary benefits

Even without a Westshore stop, a downtown terminal improves connectivity. Visitors train to Tampa, hop a rideshare to the airport, and fly out. That dynamic reduces friction for meetings and events and can widen the tenant pool for apartments marketed to travel-heavy professionals.

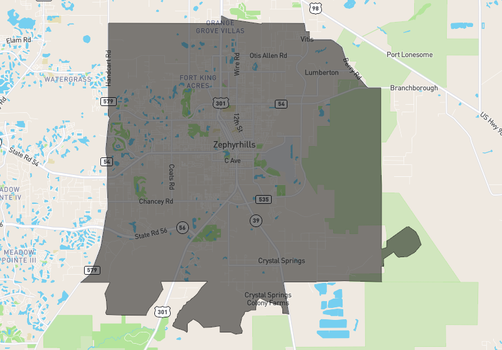

Lakeland is the wildcard

Earlier concepts mentioned a Lakeland stop. If that returns, it opens a seperate commuter shed and could boost townhome rentals and small infill apartments near the core. For now, treat it as upside, not your base case, until siting is confirmed.

How to underwrite a “maybe soon” station

Tie your pro forma to milestones you can verify. Add small rent bumps or faster lease-up only after firm steps like bond closings, a signed station site, utility relocation, or construction mobilization. When you market those claims, point to the public documents and meeting notes that back them up.

Underwrite the announcement effect, but keep it modest. A reasonable starting point is a 1–2% annual rent premium in the immediate station area once construction is clearly underway; re-rate after the first month of revenue service. If you’re modeling lease-up for mixed-use or hospitality, budget for first-/last-mile: parking strategy, curb management, and safe walking routes. Those basics will carry more weight than fancy finishes in the first year.

Key risks to watch

Financing risk

The $400M bond ask is one piece of a bigger capital stack. Ratings changes and any delays in restructuring existing debt could slow the timeline. Keep an eye on official notices, not rumor.

Schedule risk

Planning, design, and station entitlements can drag if agencies request more study or if the chosen site needs extra work. The Sunshine Corridor analysis and local hearings have been ongoing and will continue to shape sequencing.

Ridership and pricing risk

If Orlando–Miami demand softens or fares stay too high, Tampa’s start could stage in slower. Watch monthly updates so your lease-up assumptions don’t outrun reality.

Political and access risk

Station access—parking, drop-off, sidewalks, and bike links—will shape early adoption. Quick wins on those basics will matter more than splashy renders.

Bottom line for Tampa Bay investors

The Tampa extension is moving on two tracks—planning and financing. The planning has been real for years; the financing will keep evolving and could turn a corner if bonds close and design packages move. If you buy or build near the likely station area, the upside is a durable access story that supports mixed-use, stronger retail ground floors, and modest rent premiums.

Don’t trade on speculation. Trade like milestones will unlock value in steps—and make sure your deal still pencils if service slips a year. If momentum holds, the neighborhood around the station will definitly tell a different story five years from now.