~ 5 min read

Imagine trying to sell your home in Tampa or St. Petersburg, but buyers aren’t biting at your asking price. You locked in a rock-bottom mortgage rate a few years ago, so selling means giving up that cheap loan. Instead of slashing the price, you decide to rent the home out. You never planned to be a landlord, but here you are – an “accidental landlord.” This scenario is playing out across Tampa Bay as many would-be sellers opt to rent their homes rather than sell, reshaping both the for-sale and rental markets.

Rising “Accidental Landlords”

In 2024, accidental landlords are on the rise, especially in Florida. An accidental landlord is just what it sounds like – someone who becomes a landlord by circumstance rather than intention. Common reasons include difficulty selling at the desired price, job relocations, or simply timing the market wrong. In today’s market, high mortgage rates and a cooling sales market are prime culprits.

“As interest rates are high and the real estate market is slow, homeowners are struggling to sell their homes at the desired price. Instead of selling for less or pulling the listing, they’re choosing to rent out their homes,” explains one Tampa property manager.

For many, it’s a rational calculation. Mortgage rates for a 30-year loan have shot up to around 6.5–7%, whereas in early 2021 they hit historic lows near 2.6%. According to the CFPB, nearly 60% of active mortgages today carry interest rates below 4%, a legacy of the pandemic-era refinance boom. Homeowners with these ultra-low rates are reluctant to “give up” their loans by selling. As one observer put it, “Until the interest rates drop down to under 5.5%, maybe 5%, you’re not going to have many people selling their homes.” In other words, cheap debt has “locked in” sellers, leading them to rent out homes they would have sold in a more normal market.

“It’s such a thin market on the sales side right now. Folks want to move, and this is another outlet for them,” said the Parcl Labs CEO about owners turning to rentals.

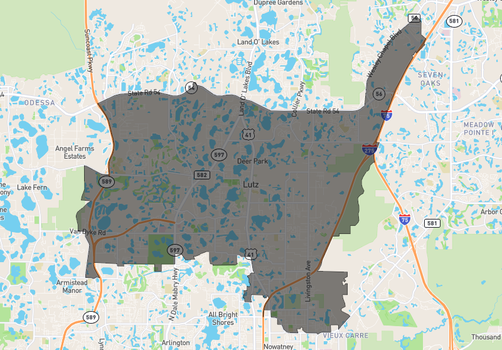

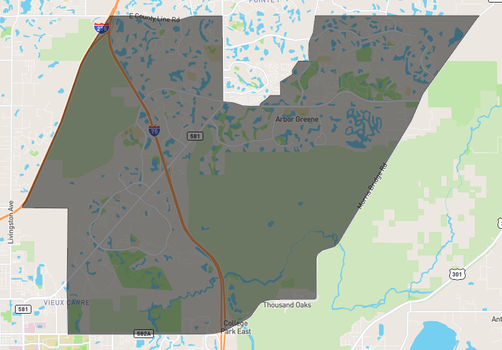

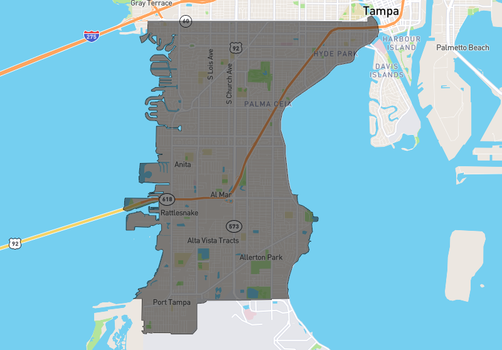

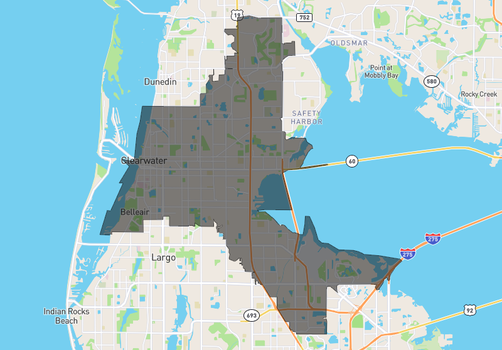

There’s no official count of accidental landlords, but industry clues suggest it’s significant. A 2024 National Association of Realtors survey found 1 in 5 repeat buyers kept their prior home as a rental/investment instead of selling. And in some Sun Belt markets like Tampa, 3%–8% of homes listed for sale in late 2024 ended up being rented out within 60 days of listing removal. In Phoenix – perhaps an extreme case – over 15% of would-be sellers pivoted to become landlords during that period. Tampa’s percentage was likely on the higher end of that range, reflecting how common this phenomenon has become in our region.

Tampa Bay’s Housing Market Is Cooling Off (But Not Crashing)

To understand this trend, let’s look at the for-sale market in Tampa and St. Pete. After the frenzied pandemic boom, things have cooled:

Inventory climbing: Active listings have surged from record lows. In early 2021, Tampa Bay’s entire metro had fewer than 4,000 homes on the market; by early 2025, active listings swelled to about 18,000, the highest in years. Months of supply—which measures how long it would take to sell the inventory—roughly doubled from about 3.6 months a year ago to about 5.4 months now. In September 2024, Tampa Bay had a 4-month supply of homes versus the roughly 6 months considered a balanced market. This shift is partly seasonal and partly a sign of more sellers (and fewer buyers) than during the COVID boom.

Active home listings in the Tampa–St. Petersburg metro have climbed sharply from pandemic lows, easing the extreme seller’s market of 2021–2022. (Source: Realtor.com housing inventory data)

Sales slowing: Home sales volumes are down—2024 saw far fewer buyers than the prior few years. In the fall of 2024, closed sales were down 17% year-over-year. Many listings are sitting unsold for longer. As of November, active listings in Tampa Bay were up about 19% from a year before, and 57% of homes were on the market 60+ days without a buyer. A local broker noted that “listings are piling up… homes for sale are sitting on the market for months at a time, causing stale inventory to pile up.” Essentially, it’s taking longer to sell—the median days on market in Tampa is about 48 days now, up by 10 days from a year prior.

Prices plateauing: After years of steep gains, home prices have flattened. The median single-family home price in the Tampa–St. Pete–Clearwater metro was $409k in September 2024, actually down about 1.4% from the year before. (It’s still up an eye-popping 65% versus five years ago, so most long-time owners sit on hefty equity.) In the city of Tampa, median prices in early 2025 are hovering around $408k, about 4% higher than a year prior—a modest uptick that pales in comparison to double-digit annual gains seen during 2020–2022. In short, prices aren’t really falling much, but they’re not rising like before. Many sellers remain price-sensitive; roughly 43% of listings had a price drop as of spring 2024 (up from 35% the year prior) as owners tried to find the market’s clearing price.

For local homeowners, this market presents a dilemma. If you list your house now, buyers are no longer in bidding wars and may not meet your asking price. But you likely have a ton of equity and that sweet 3% mortgage. That calculus—is it worth selling now or waiting?—is leading many to Plan B: rent it out and wait for a better market.

Case in point: A young Tampa owner on Reddit described buying his home in 2020 and watching values explode through 2022. Now relocating, he’s “struggling with deciding if I should rent it out or sell.” With a $1,590 monthly mortgage at 3.5% on a house worth about $360k, he could rent it for around $2,200 and cover the mortgage. He loves the house and doesn’t need cash for a new down payment immediately, so he’d “hate to see it go to a cash buyer who’ll tear it down or flip it.” His fiancée is likewise renting out her own house. For them, landlording feels like the more attractive interim solution.

A Softer Rental Market (Finally) Gives Renters a Break

In Tampa Bay, homeowners becoming accidental landlords and a surge of new apartments have dramatically increased rental supply, pushing vacancies to a 15-year high and causing rent prices to fall. By late 2024, median rents were down over 10% year-over-year, marking a significant reversal from the pandemic-driven rent hikes of 2021–2022. Landlords are responding with price cuts and concessions, making it a clear renter’s market in Tampa Bay for the first time in years.

This is disastrous for recent or would-be rental investors. Rental rates have been pushing highs the past 2 years and still incapable of cash flowing against high property values, insurance and taxes.

Why Rent Instead of Sell?

Several factors explain why Tampa Bay homeowners are choosing to become accidental landlords. The primary reason is the "golden handcuffs" of historically low mortgage rates. Many homeowners locked into rates around 3% during the pandemic, significantly below today’s rates of 6–7%, which would substantially raise their monthly payments if they bought a new home now. This “lock-in effect” means many are reluctant to sell and give up their cheap mortgages. Additionally, homeowners now face challenges getting the desired price for their homes. Unlike the competitive bidding wars of 2020–2021, sellers today often need to cut prices or offer incentives due to increased inventory and cooling buyer demand. Rather than accept lower offers, many choose to rent their homes, betting on future appreciation and waiting out market conditions.

Other reasons include historically strong rental demand in Tampa, with roughly half of the city’s properties renter-occupied and average rents still above the national average. Owners often find renting covers costs and even generates extra cash flow, making renting a practical alternative. On the flip side, rising home insurance and maintenance costs are complicating sales; sellers fear these higher costs might deter buyers or depress prices, prompting them to rent temporarily until conditions stabilize. Finally, emotion and flexibility play roles too—some homeowners simply aren’t ready to sell their cherished properties yet, viewing renting as a flexible trial period or a way to preserve personal attachments until the market or personal circumstances change.

Impacts to Buyers, Sellers, and Investors

The rise of accidental landlords is rippling through the Tampa Bay housing ecosystem in several ways:

Tighter Supply for Homebuyers:

Every homeowner who chooses to rent instead of sell represents one less listing on the market. Tampa Bay’s inventory, while up from extreme lows, still isn’t back to long-term “normal” levels—we’re around 4–5 months’ supply, versus about 6 months in a balanced market. Buyers are noticing fewer move-up or starter homes available because many are leased out instead. This can limit choices, especially for family homes in desirable neighborhoods. On the flip side, homes currently for sale are lingering longer, giving buyers less frenzy and more room to negotiate compared to 2021. It’s a mixed bag: fewer options, but more leverage with sellers who know buyers have other choices, including renting.

“Stuck” Homeowners and Delayed Moves:

For sellers, becoming an accidental landlord can serve as a temporary solution—but it's not always easy. Managing rentals comes with hassles and risks. “Not everyone in the world is cut out to be a landlord,” cautions one property manager. Late-night maintenance calls, tenant turnover, and legal requirements can quickly overwhelm inexperienced landlords. Some accidental landlords may eventually find themselves unwilling or unable to continue, especially if rentals fail to cover costs or if headaches multiply. For now, many feel renting out their homes is worthwhile. As one homeowner described, renting his house was “cumbersome” with many steps, “but the pros outweighed the cons in this situation, especially right now.” We might see more small rentals hitting the market eventually if these reluctant landlords decide it isn’t worth it. In the short term, however, fewer listings hit the market, keeping inventory lower and supporting prices. Tampa’s prices have stayed resilient partly because not everyone who wants to move is actually listing their home for sale.

More Rental Options (and Competition) for Tenants:

Renters in Tampa Bay finally have the upper hand. Investors and accidental landlords alike compete for tenants, which translates into better deals and quality for renters. An influx of single-family rentals benefits families seeking homes with yards who aren’t ready to buy yet—far more are available now than just a few years ago. We’re also seeing formerly owner-occupied homes, often with nicer upgrades, enter the rental market. One Clearwater condo listing noted, “We rehabbed this unit to sell, but decided to rent instead. You won’t find another condo rental that’s been fixed up to this quality.” Renters now have access to higher-end properties previously unlikely to be rentals. Still, tenants should carefully vet landlords, as inexperienced ones may lack knowledge of landlord-tenant laws or proper maintenance reserves. Overall though, more accidental landlords means greater choice and more competitive rents.

Pressure on Dedicated Investors:

Real estate investors in Tampa Bay—from mom-and-pop landlords to large institutions—face a more competitive rental landscape. The surge of rental supply, including from accidental landlords, increases vacancies and slows rent growth, squeezing yields. Professional landlords must compete with “unintentional” competitors, many of whom are satisfied simply covering their mortgages, exerting downward pressure on regional rents. In late 2024, local landlords saw rents decline roughly 1–6%, struggling to increase rent upon renewal. At the same time, costs such as insurance, taxes, and loan interest remain high. Some institutional investors have even sold homes at losses in Florida, signaling market normalization. However, there’s a potential silver lining for investors: if accidental landlords tire or encounter trouble, their properties might eventually hit the market, creating buying opportunities. Additionally, fewer forced sales now could mean pent-up inventory in the future—if rates drop, many of these landlords might finally sell, providing investors with attractive purchases. For now, rental investors in Tampa Bay must remain realistic about near-term rent growth (likely flat or modest) and anticipate heightened tenant competition.

Tampa Bay’s accidental landlord trend is increasing rental supply while constraining homes available for sale. Buyers still find the market competitive—albeit saner than the frenzied days of 2021; sellers are reluctant to list unless forced; and renters are catching a break for the first time in years.