The Concept of Padsplits: A Revolutionary Rental Model

Breaking Down Padsplit

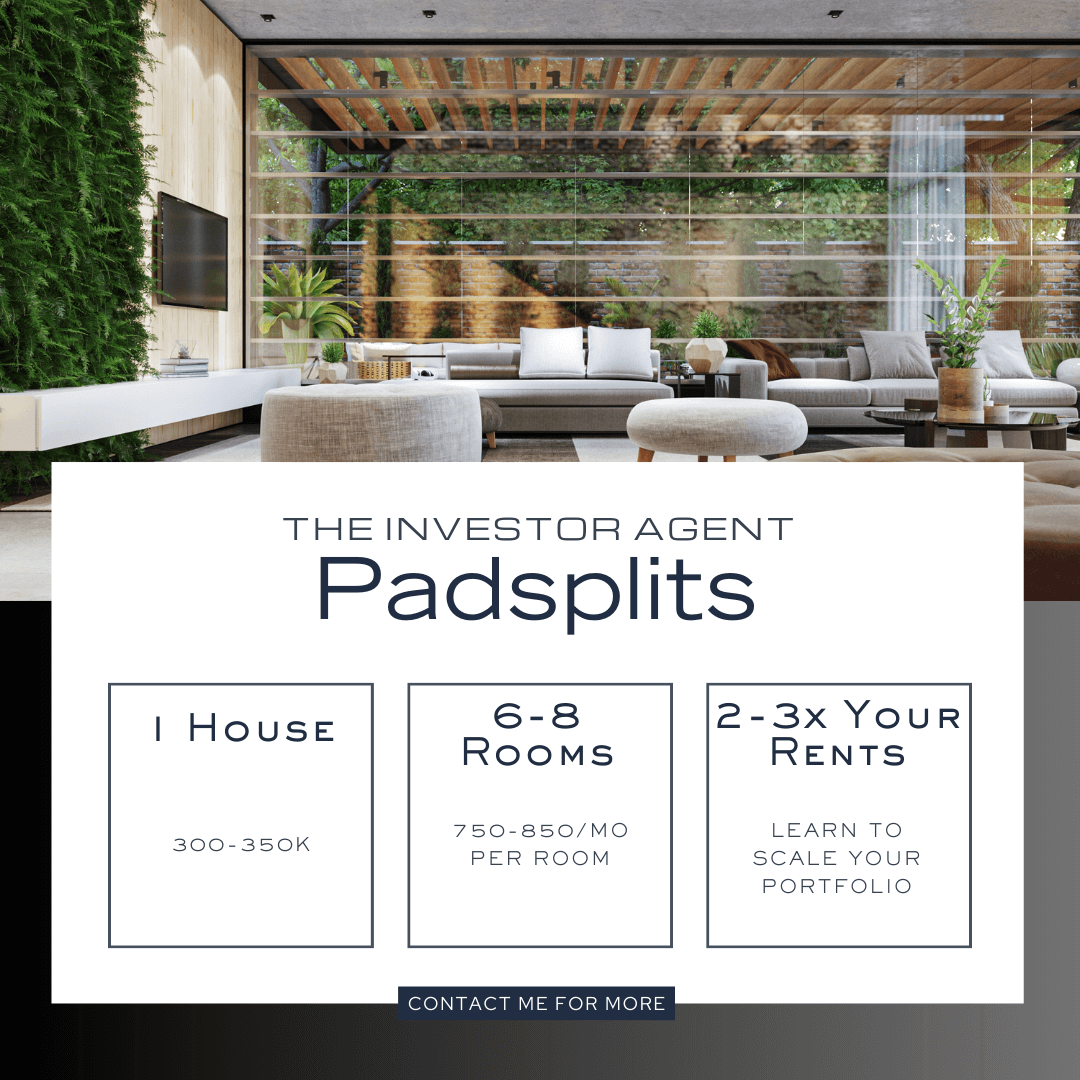

In the evolving landscape of real estate, one emerging trend that is capturing attention is the concept of Padsplits. The name has caught on – much like how we talk about Airbnbs. These are essentially shared housing units designed to provide affordable living spaces, especially in metropolitan areas. Padsplits take a single-family home and break it into multiple rental units, usually bedrooms, that are rented out individually.

The Padsplit model is especially popular in bustling cities like Tampa and St. Petersburg, where the cost of living is high and renters are looking for more affordable options. What makes Padsplits unique is that they incorporate a co-living model, where tenants share common spaces like the kitchen and living room, while still maintaining private sleeping quarters.

Why Padsplits are More than Just Rentals

Padsplits are not merely a rental option; they are an investment opportunity. For property owners looking to optimize their investment property’s rents, Padsplits offer an intriguing possibility. By converting a standard property into a Padsplit, landlords can potentially increase their rental income by charging per room rather than per property. This opens up a whole new revenue stream, turning what could be a single rental income into multiple streams from the same property.

The Growing Popularity of Padsplits in Tampa and St. Petersburg

Why Tampa and St. Petersburg?

The rise of Padsplits in Tampa and St. Petersburg can be attributed to the growing housing demand in these urban centers. Both cities have witnessed a surge in population, which has consequently led to an increase in rents. This provides a fertile ground for investment property owners to dive into the Padsplit model. Given that these cities are continuously expanding, the demand for affordable rental options is unlikely to subside soon.

Making the Investment

Investing in Padsplits is increasingly seen as a savvy move for those interested in the Tampa and St. Petersburg rental markets. Not only do these properties have the potential for higher rents, but they also offer a way to mitigate vacancy risks. If one tenant moves out, the property owner still has income from the remaining tenants, which can be a significant advantage in maintaining steady cash flow.

How to Get Started with Your Padsplit Investment Property

Identifying the Right Property

The first step to launching your Padsplit is identifying a suitable property for conversion. This requires a keen understanding of your target renter demographic and local zoning laws. Some areas may have restrictions on the number of unrelated individuals who can live in a single-family home, which could impact your Padsplit plans.

Capitalizing on the Padsplit Model

Once you’ve identified a suitable property, the next step is conversion. This involves some upfront investment to ensure each unit (typically a bedroom) meets local housing regulations. But don’t let this deter you. The potential for higher rents and greater tenant stability often outweighs the initial expenditure. With the right planning and execution, your Padsplit investment property could be the key to unlocking new financial opportunities.